When registering a DEWA account in Dubai, customers must pay a refundable DEWA deposit. If you are leaving the country or moving to a different area, you may seek a return of your DEWA deposit. But how can you get your DEWA deposit refunded? We outline the methods for obtaining your refund with simplicity.

GETTING YOUR DEWA DEPOSIT REFUND

DEWA, or Dubai Electricity and Water Authority, has linked its services with Emirates NBD and Western Union to make requesting your DEWA contribution easier.

However, before receiving your DEWA deposit return, ensure that you have completed the following criteria:

- You have vacated the property with the DEWA connection.

- You have provided an updated email address and phone number.

- You have paid off any outstanding amounts on your prior DEWA bills.

Once you’ve completed the procedures above, here’s how you seek a DEWA deposit return.

- Step One: Go to the DEWA website and log in to your account. You’ll be led to your account’s dashboard.

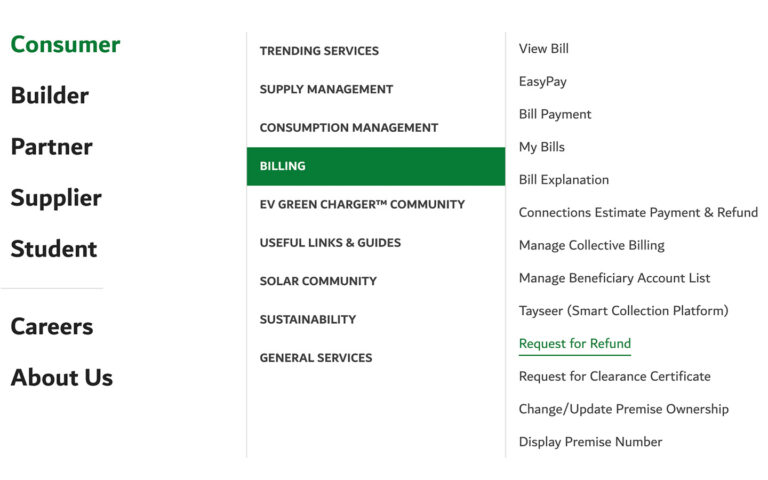

- Step Two: Select billing from the menu at the upper left. Select Request for Refund from the list of options.

- Step Three: A green menu with the words ‘Apply Online’ will appear. When you click this, you will be led to a page where you may pick the connection for a refund and pay off any outstanding balance.

You can choose whether you want your funds repaid by IBAN or Western Union.

- Step Four: If you choose IBAN, you will be required to upload the IBAN bank proof that includes the beneficiary’s name. You will be required to enter a verification code delivered to your phone number or email address.

Once completed, click submit, and you will receive confirmation that the request has been filed.

If you pick Western Union, Cheque, or transfer to another active account, specify the route via which you will get your verification code (mobile number or email address). When you enter this code, you are submitting the service request application, and you will receive confirmation that your request has been received.

If you reside overseas, Western Union is the ideal option since it allows you to withdraw your DEWA deposit from any branch worldwide. You may receive your refund from a different city within the same country, with the exception of Mexico and the United States.

Each medium has a restriction on the number of refunds that may be deposited.

- The IBAN limit is less than AED 200k.

- Western Union has a limit of AED 20 to 18k.

- Cheques are for sums more than AED 200k

If you pick Western Union, you will be notified when your Money Transfer Control Number (MTCN) is generated. You may receive your DEWA refund by presenting this MTCN to any Western Union branch.

Remember that the MTCN is valid for 30 days.

- Step Six: You may receive your refund from the same website where you applied for it. Switch to the “Track Refund” area to check if it is being processed. You will get your refund within three to six days, depending on the method you choose.

FAQS ABOUT DEWA REFUND

HOW CAN I CONTACT DEWA ABOUT MY DEWA DEPOSIT REFUND?

You can contact DEWA by email at customercare@dewa.gov.ae or by phone at +971-4-601-9999. Alternatively, you can visit the DEWA website and use the Hayak service to talk with a representative online.

WHEN WILL I RECEIVE MY DEWA DEPOSIT REFUND?

Your DEWA deposit return usually arrives between three and six days. This depends on the medium chosen.

WHAT ARE THE FEES FOR REQUESTING A DEWA DEPOSIT REFUND?

- IBAN: No charges

- Western Union: USD 5 or 1% of the refund amount, whichever is higher (Western Union exchange rates are applied for each transaction)

- Cheque: AED 20 plus VAT

- Transfer to another account: No charges